Facebook is arguably the most effective outreach and marketing platform ever created because you can target very-specific audience segments.

That being said, you will find you can quickly spend money on Facebook with very little to show for your investment if you do not have a well-thought-out strategy.

In this case study, I’m going to share the exact campaign* that we used to generate $3 leads for a personal loan company.

For the skimmers, here is what I’m about to share with you:

Ready? Let’s do this!

*Spoiler alert: the client asked us to turn off the campaign after four days because they couldn’t keep up with the number of leads!

Here is the big problem with generating leads online:

People are on heightened alert when it comes to sharing their contact information online. Not surprisingly people are even more skeptical about sharing their contact information when it comes to their finances!

That is why you need to make an extremely enticing offer to get them to believe the value you are providing is enough to trade for their precious email and phone number.

In a perfect world, everyone would take out a loan if the terms were right.

However, here’s what I love about Facebook ads…

You can generate more leads at scale better than any other type of advertising.

For example, this client came to us and said:

“We practice traditional marketing and are tired of the inconsistent results. We buy lists. Do direct mail. But we want to find new customers online. Do you have any recommendations?”

Do we have any recommendations?!

We sure do!

At its core, our engagement was about solving two problems:

So how were we able to help our client achieve its goals?

There are lots of options (SEO, Google Ads, Display Marketing) but we focused on Facebook ads!

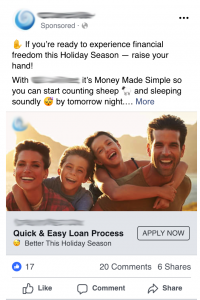

For this client, we ran four different ad images.

Two were of young couples (for recently engaged and newlyweds), and two were of adults with children (for families).

The two ads below were the winners (that’s why we test!).

We created ad copy focusing on the emotions that come along with the stress of paying off multiple credit cards.

We wanted to be whimsical and add a human element to the ads because most financial ads are serious and straight to the point. We knew this would differentiate ourselves within the marketplace.

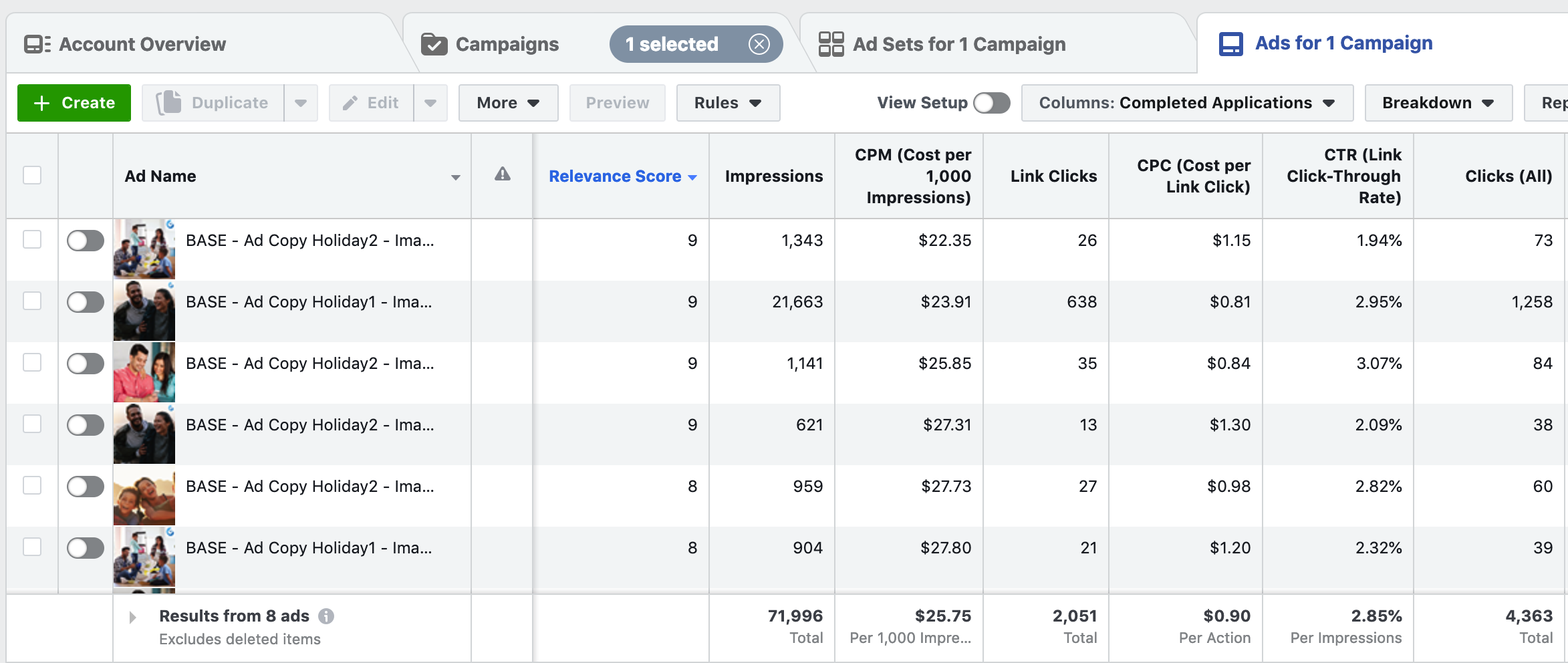

Our standard process is to allow all of our ads to run, unimpeded for three full days or when Facebook’s pixel has been optimized (whichever comes first) to get more consistent delivery results.

Once we get to day 3, we start to look at which images and copy combinations are performing best. Most of our ads had high relevance scores of 8 or 9, which means users on Facebook were receiving the ads well.

After the 3rd day, we turn off any clear losers that are not within our target KPIs and let the additional budget go towards the ones we know are working. Over time, this process allows us to find our top 3 performing ads. We then rotate these three ads within the audience to maximize the assets use before ad fatigue settles in.

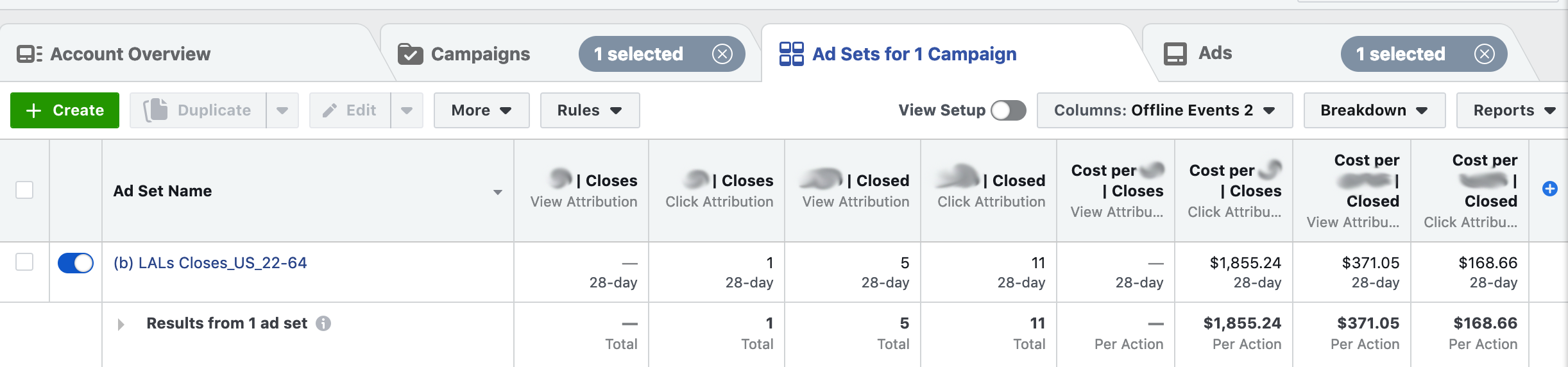

Ad Objective: Conversion

Impressions: 72,034

(How many people saw the ad.)

Frequency: 2.10

(How many times people saw the ad on average.)

Clicks to Website: 2,054

Cost Per Click: $0.90

Total Cost: $1,855.24

Relevancy Scores: 8s & 9s

(Score out of 1-10 how relevant the ad was to people who saw it.)

Headline: Quick & Easy Loan Process

Text:

✋ If you’re ready to experience financial freedom — raise your hand!

With [YOUR COMPANY NAME], it’s money made simple so you can start counting sheep ? and sleeping soundly ? by tomorrow night. Enjoy ONE payment and a personal loan that’s financially doable.

Tap [Apply Now] to fill out our quick and simple online application. You’ll be happy ? you did!

Call To Action: Apply Now

I know I know…

I told you the results in the title of the blog post. Or did I?

But, before I share the revenue this campaign generated, consider this for a moment:

In the past, our client would spend upwards of $200 per inbound lead using mailers. That is PER LEAD. Not per sale.

Not a very good ROI…

So, during the 24 days, this campaign ran (remember we had to turn it off), here were the results:

Leads Generated: 632

Cost Per Lead: $2.97

Unique Landing Page Views: 1,800

Conversion Rate: 35%

Sales: 16

Cost Per Sale: $115.96

Sales Revenue: $48,000

Of the 1,800 people that came to the homepage, 632 filled out a personal loan application…that’s a 35% conversion rate. That conversion rate is INSANE because this was an ad to a “cold audience.”

Meaning it was people who have never heard of our client before.

We were able to attribute 16 closed loans and debt consolidations back to this campaign through Facebook’s Offline Events feature. The average revenue generated from a closed loan or debt consolidation is $3,000.

With this campaign, we’ve given our client a more reliable and cost-effective way to generate leads and sales while building brand awareness in the marketplace.

Our client now knows every $115.96 invested into Facebook ads will generate 1 closed loan or debt consolidation.

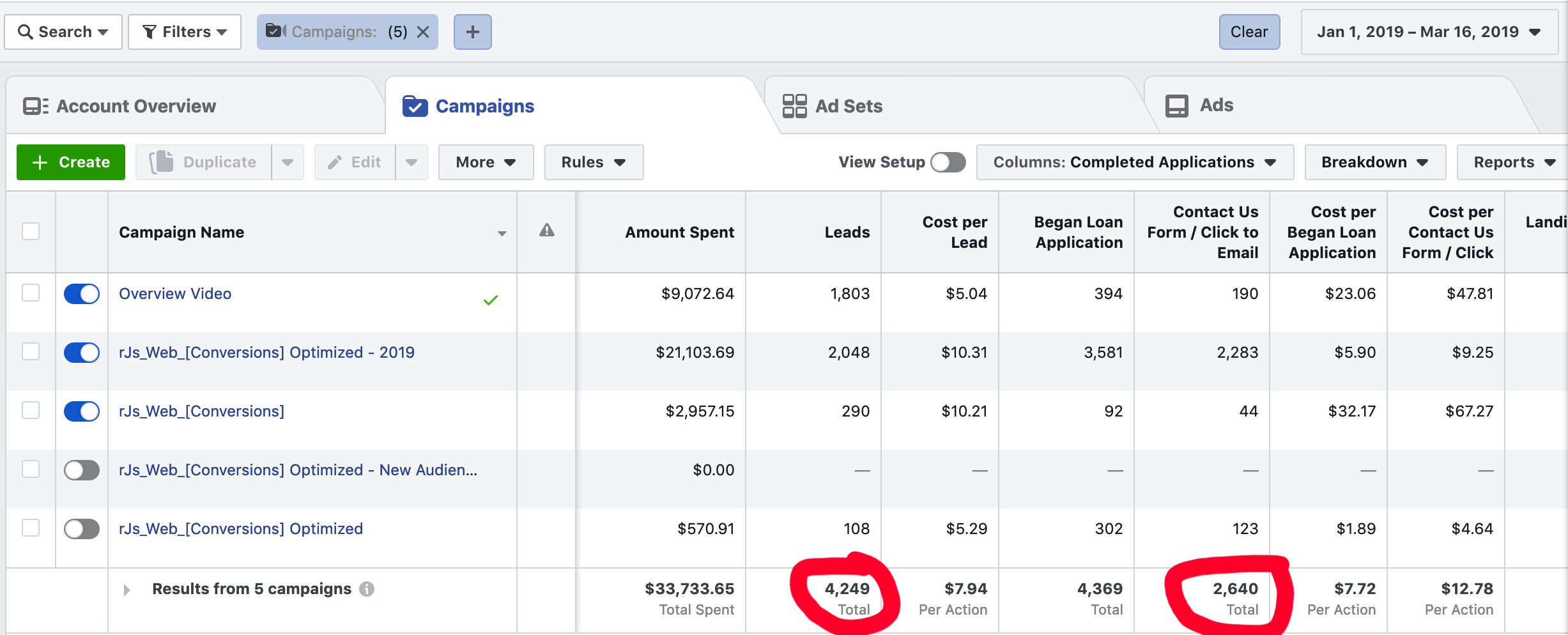

Not to mention this case study does not take into account the additional 4,249 leads we have generated or 2,640 contact us form submissions since we turned the campaigns back on ?.

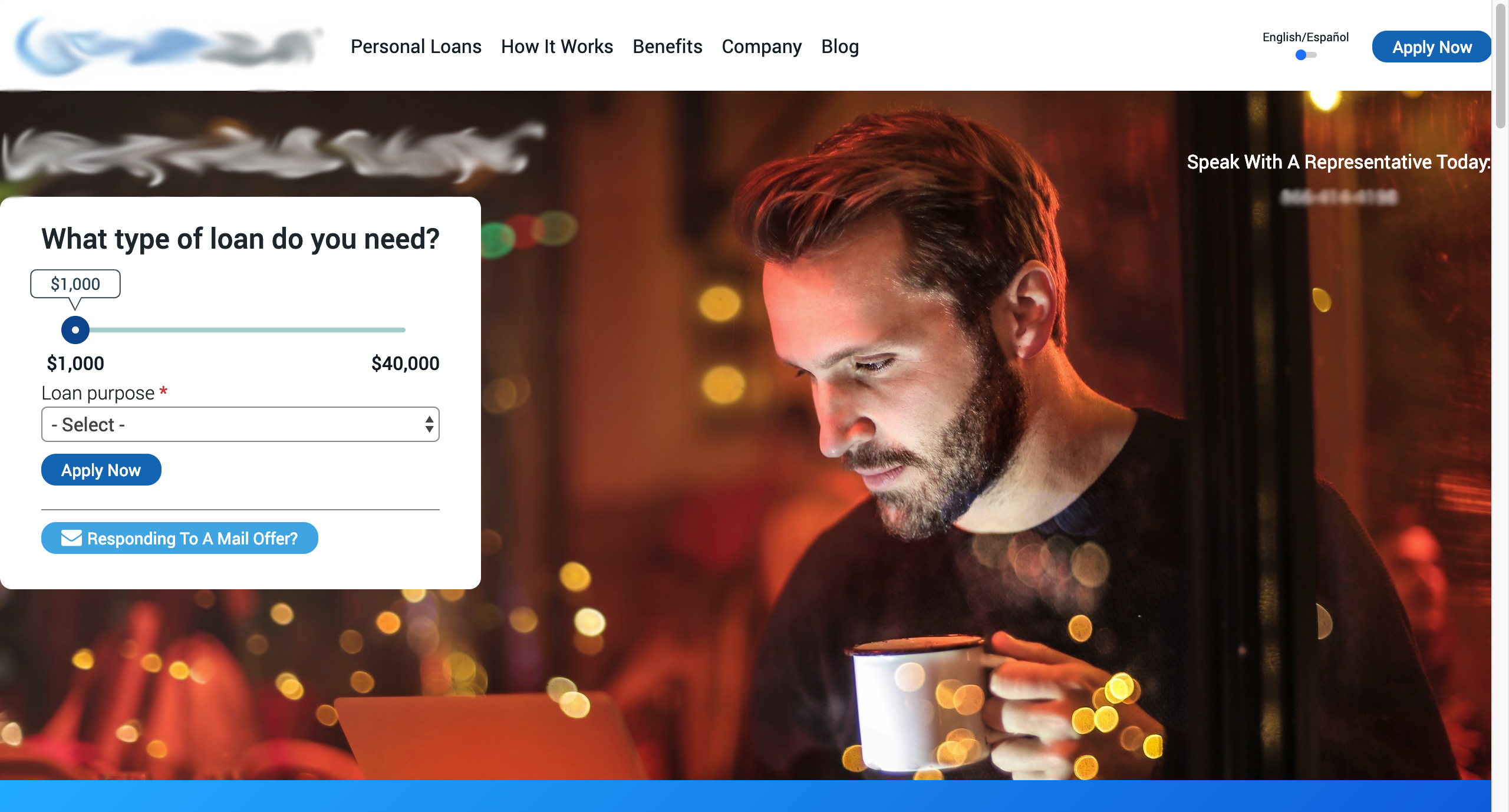

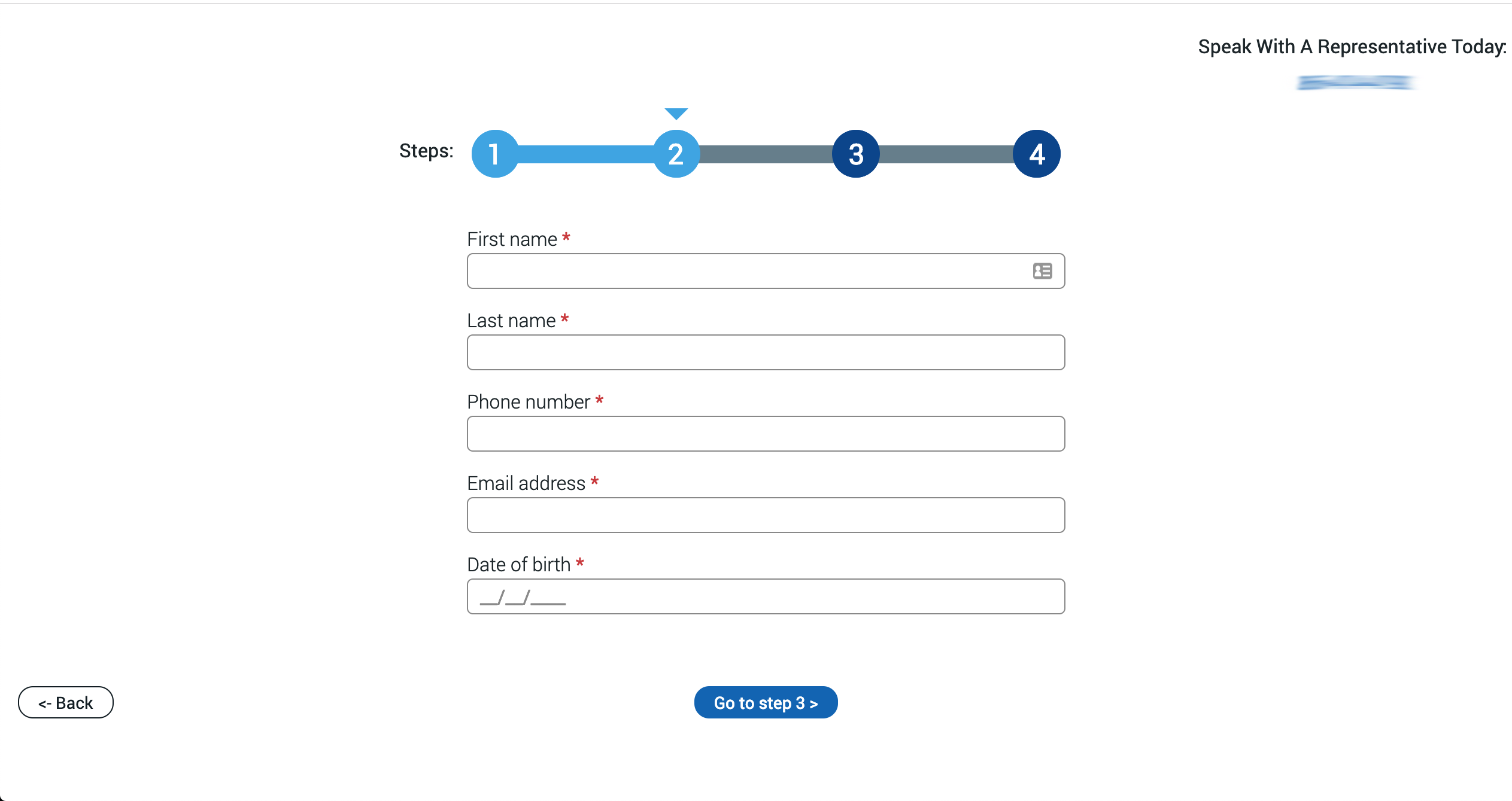

So what happens when people clicked on the ads?

Knowing that we would scare off people on the first page if we asked for their name, email, and phone number, we instead just asked the amount and type of loan they needed.

Here’s what the homepage* looked like:

*We do not usually recommend a client push traffic to a homepage over a landing page, but we made sure all of our tracking analytics were in place to properly track all conversions.

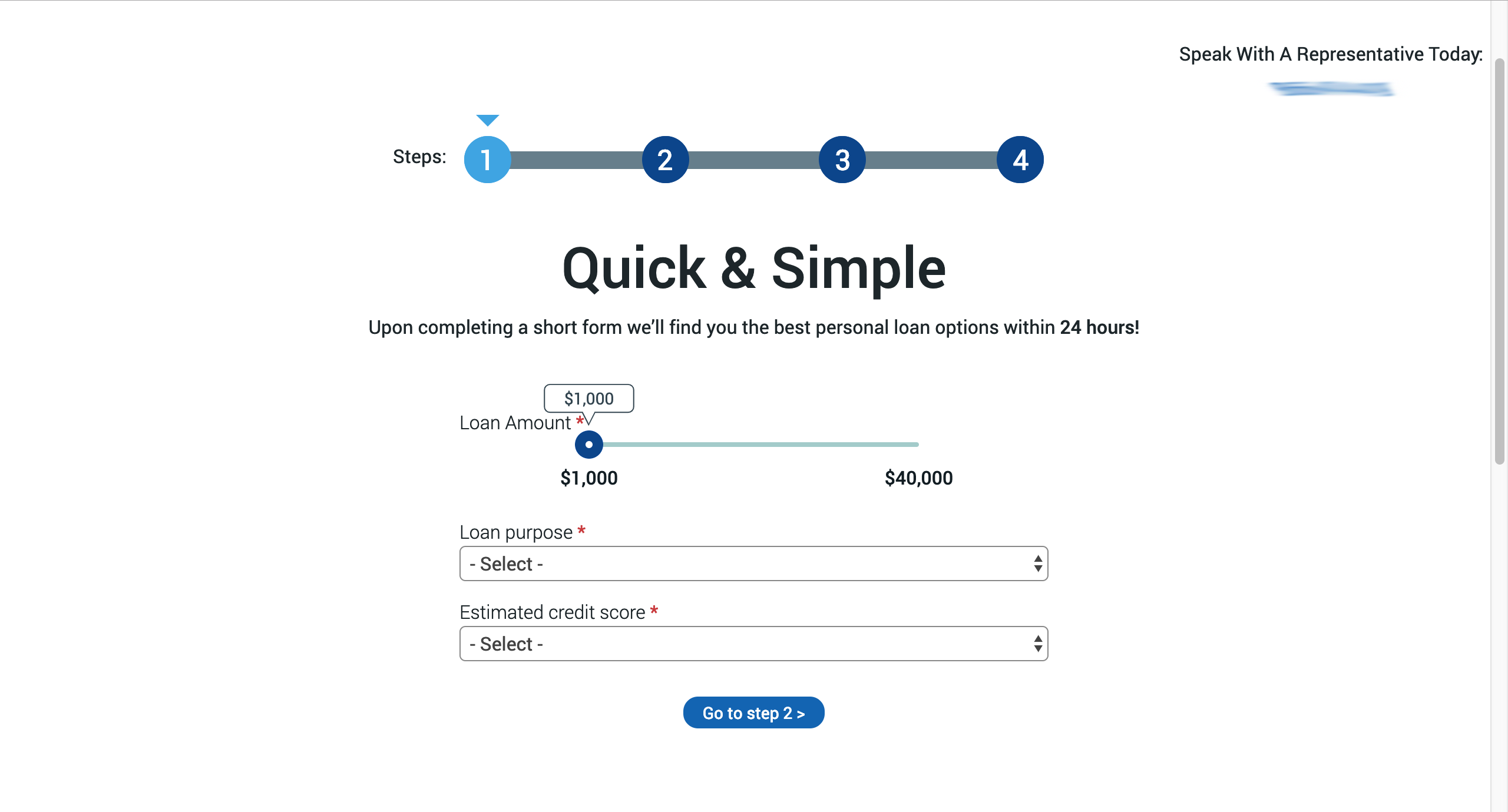

Step 1: Collect Their Loan Purpose

Again, the goal here is collect (at the very least) their loan purpose even if they don’t complete the next step.

Knowing their desired loan purpose would allow us to evaluate what types of personal loans people need most so we get a better understanding of our audiences’ needs and will enable us to create more relevant content in the future.

On the Loan Application page, we still didn’t want to add much friction, so we only asked one additional question: what is your estimated credit score?

Step 2: Collect Name, Email, & Phone Number

Nearly 28% of the people who started an application finished one; and, this is the exact reason why we broke this up into multiple steps–it makes it easier for them to complete the process and become a lead.

The other 62% would never have given us their desired loan amount and type if these form fills were on the first page of the application.

I am not going to sit here and claim that this is the most elaborate or complex campaign out there, but there is a lot of nuance and strategy involved with running Facebook ads that many people overlook.

However, with this case study, my goal was not only to show you my results but also give you the details you need to make it work all by yourself. (If that’s what you want to do…)

Not too overly complicated…Right?

But maybe you’re already running a successful business?

There’s a good chance you don’t even want to think about all this stuff; you want fresh leads for your growing business.

If that sounds like you and you’re interested in working with us on your Facebook ads…

Click here to book a time on a calendar so we can speak.

To create the best experience for ourselves and our clients, we only choose to work with those we are confident we can generate results for based on your current business.

If this is just a hobby to you or you’re just starting out, our services are probably not right for you.

All right enough with the pitch…

Learning what has worked for others is just the first step.

However, if you want to maximize your potential on Facebook, you need to understand the powerful tools that you have at your fingertips…

That’s why my partner put together this bonus, on-demand video that you can get access to below.

Here’s what we’re going to cover:

Get your website's SEO strength evaluated and start getting more customers online.

Get My Free Website Audit